What is Acorns

Acorns is an ultimate investing and money - saving app. Since its launch, it has had over a million downloads and invested billions for customers. It offers various investment options for future, kids, and retirement, along with banking features and rewards.

Features

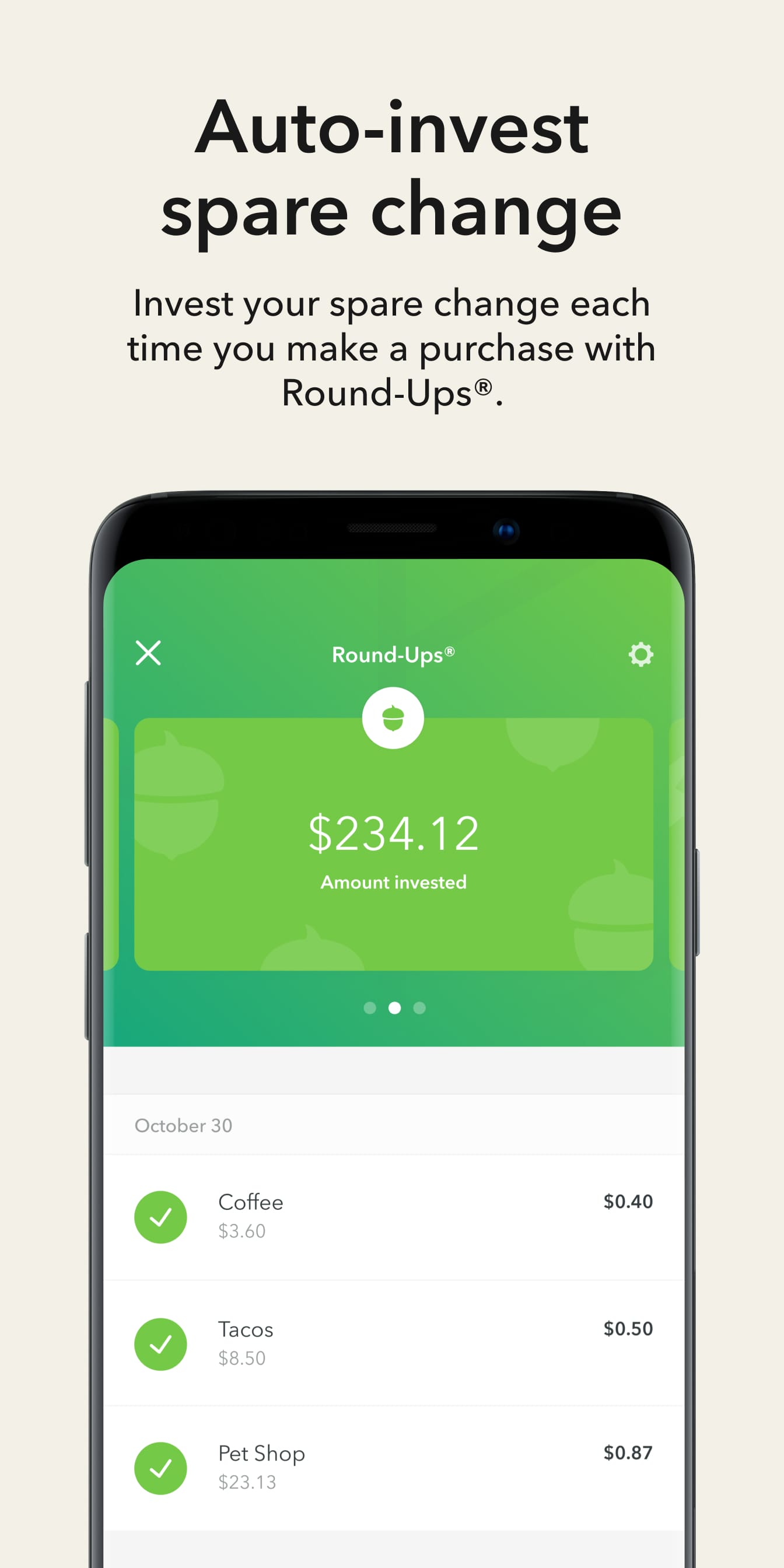

- Invest spare change with automatic Round - Ups and make recurring investments.

- Invest for kids with Acorns Early, featuring custom rewards and education.

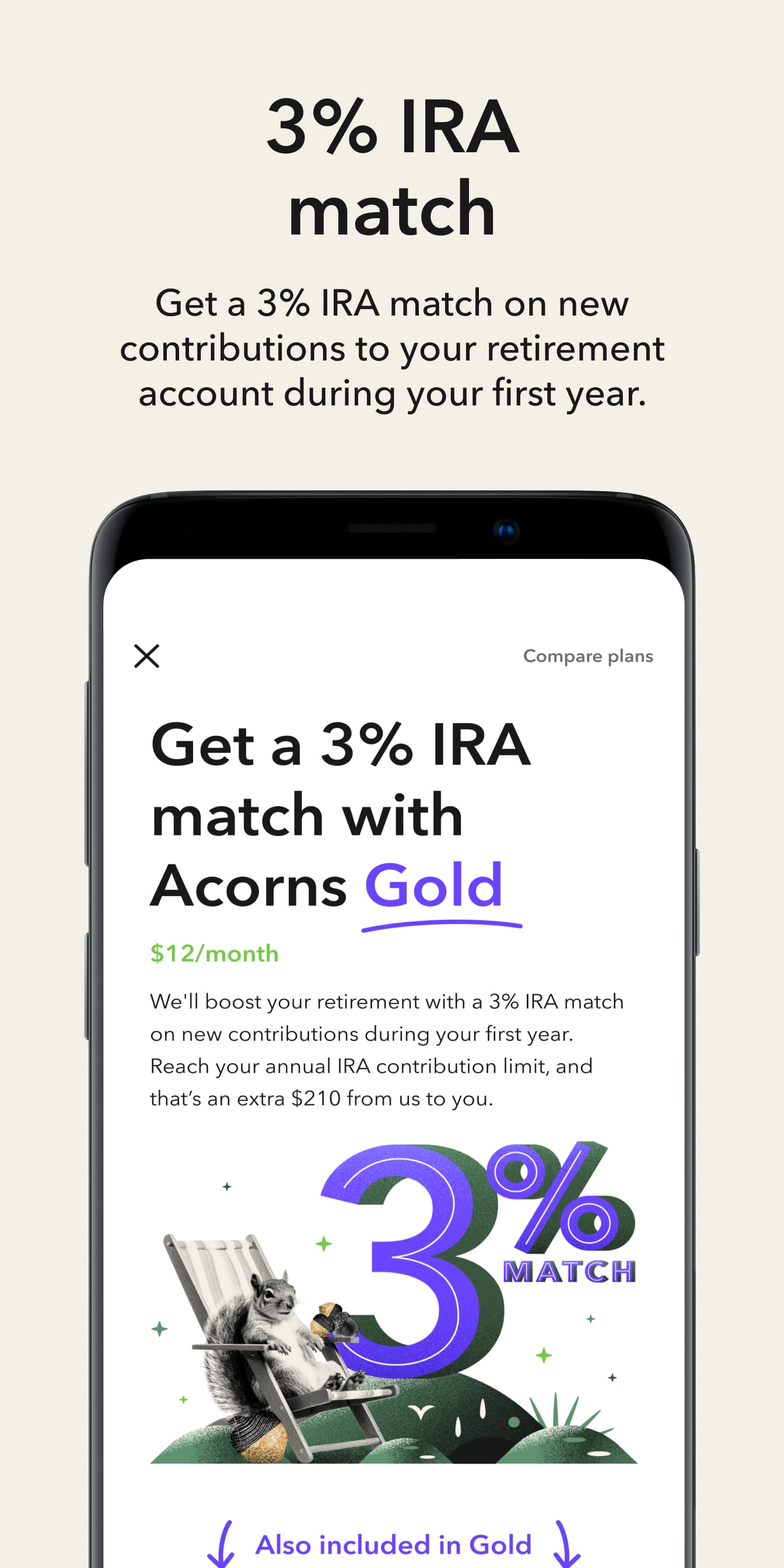

- Save for retirement with IRA options like SEP, Traditional, and Roth plans.

- Open an Acorns Checking account and get a debit card that invests spare change and a portion of your paychecks.

- Earn rewards by shopping at 3500+ brands and using the Job Finder.

- Access custom financial literacy content in the app.

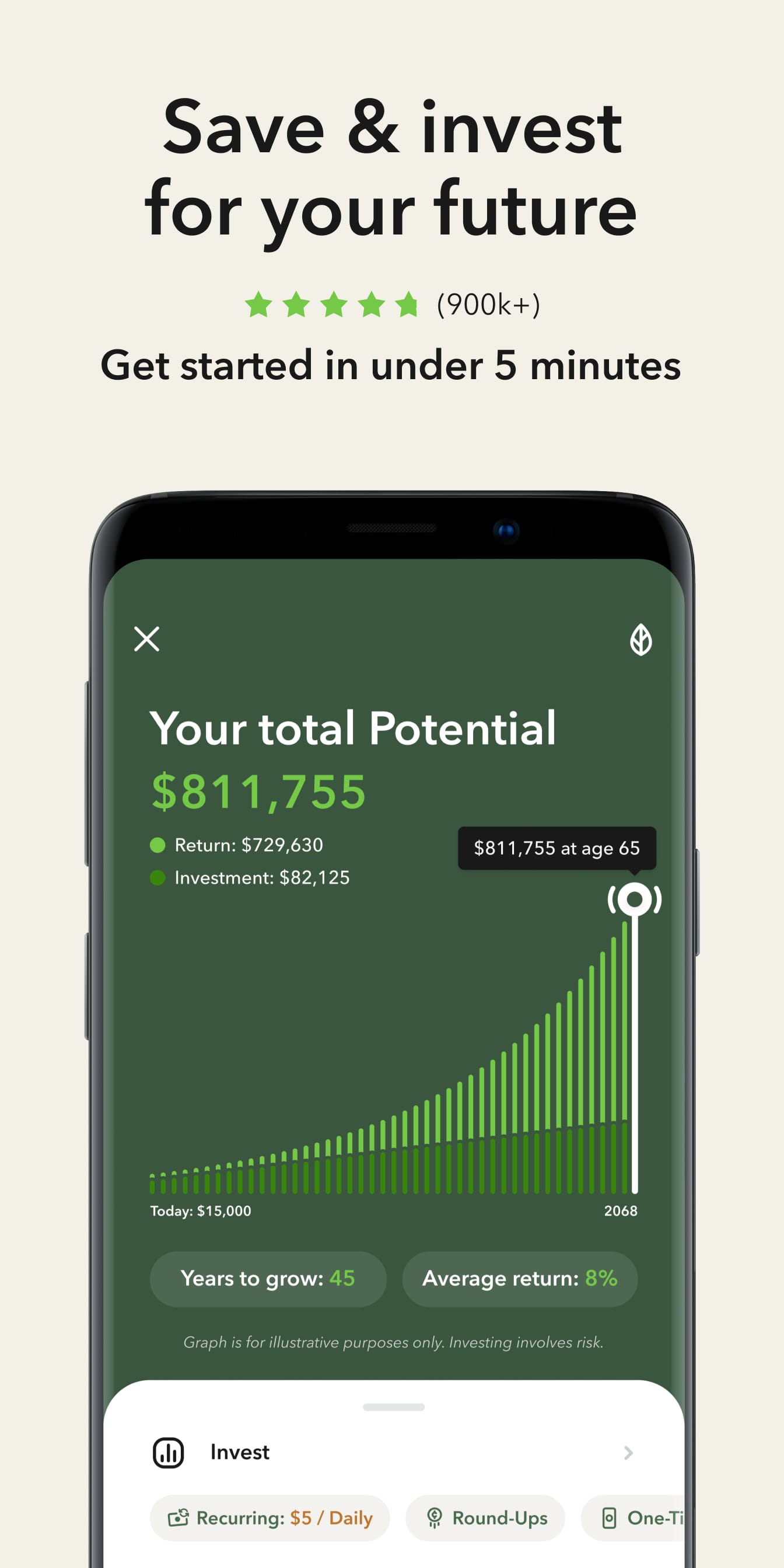

How Acorns Works

- Register in minutes and pick your investment goals.

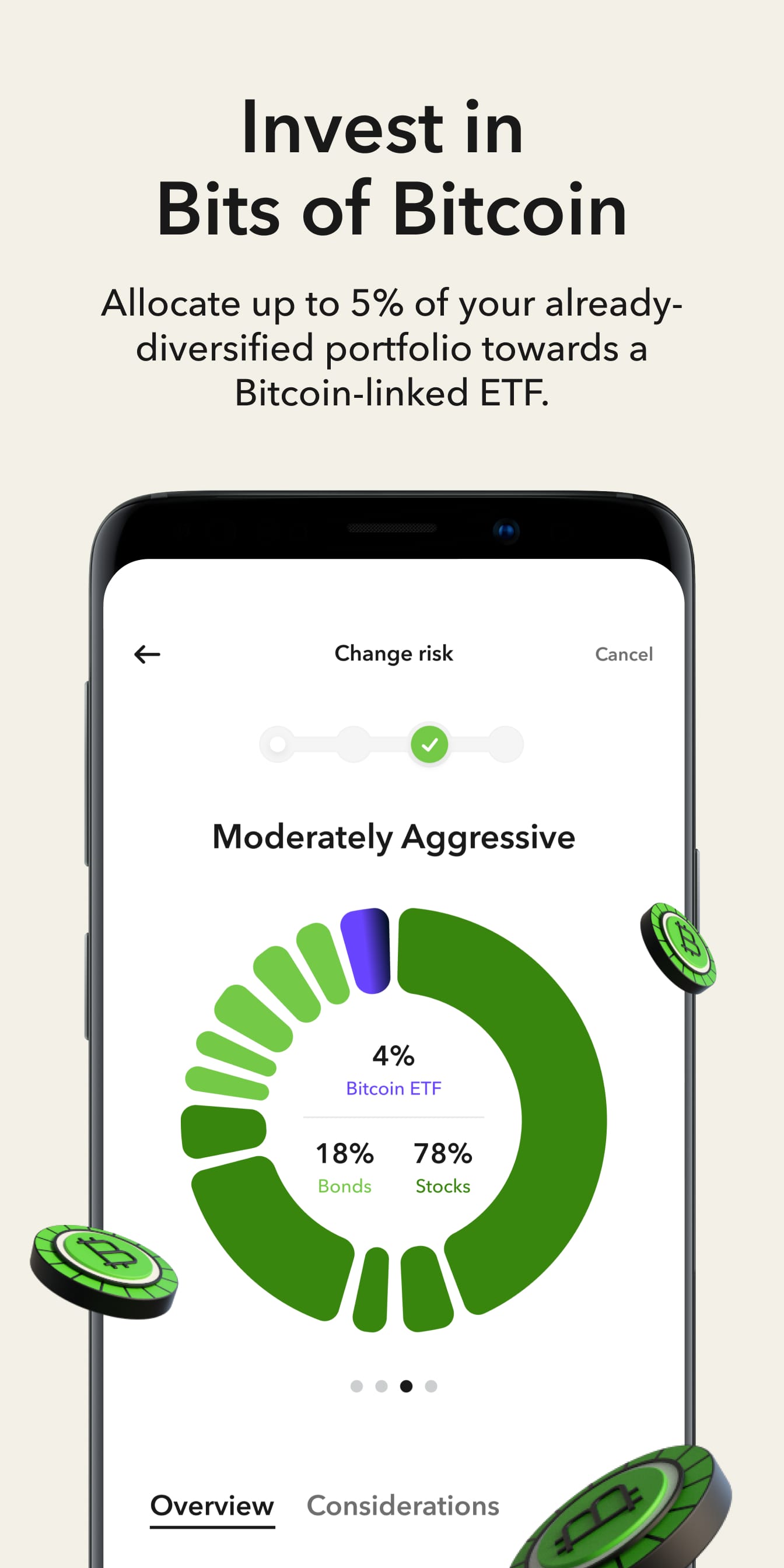

- Set up automatic Round - Ups or recurring investments, and your money is put into diversified ETF portfolios.

- Use the Acorns Checking account to invest while spending and receiving paychecks.

- Shop through the app or use the Chrome Extension to earn bonus investments.

Pros and Cons of Acorns

Pros: It has a wide range of investment options for different needs. The automatic investment features make it easy for beginners. Backed by well - known investors. Offers financial education content. Comes with security measures like SIPC and FDIC insurance. Reward programs can boost savings.

Cons: Monthly subscription fees start at $1. Market risk still exists despite diversification. Some users may find the investment options limited compared to full - service brokerage firms.

Conclusion

Acorns is a great app for those new to investing or looking for an easy way to save. With its diverse features, it caters to various financial goals. Although it has some drawbacks, its benefits like automatic investing and rewards make it a worthy choice for long - term growth. Download now to start growing your wealth.