What is Google Pay

Google Pay is a revolutionary mobile payment app that turns your smartphone into a secure payment tool. It not only replaces physical cards but also serves as a financial companion. It integrates with most Android phones, allowing easy addition of debit or credit cards. With it, you can make effortless payments, store loyalty cards, and manage receipts.

Features

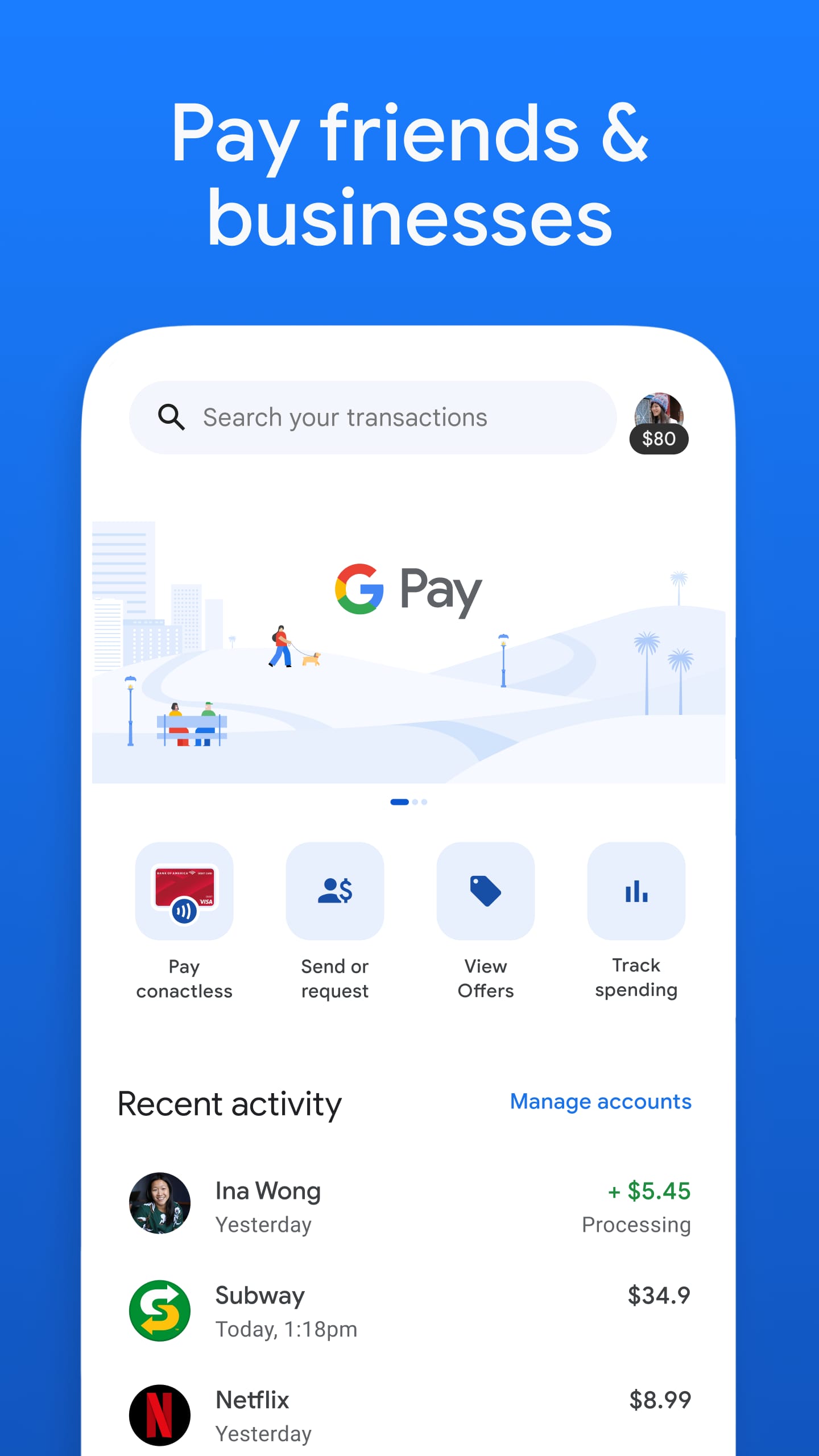

- Effortless Payments & Easy Setup: Seamlessly integrates with Android phones and enables quick card addition for fast, secure transactions.

- Store Loyalty Cards & Manage Receipts: Digitally stores loyalty cards and organizes Google Pay receipts.

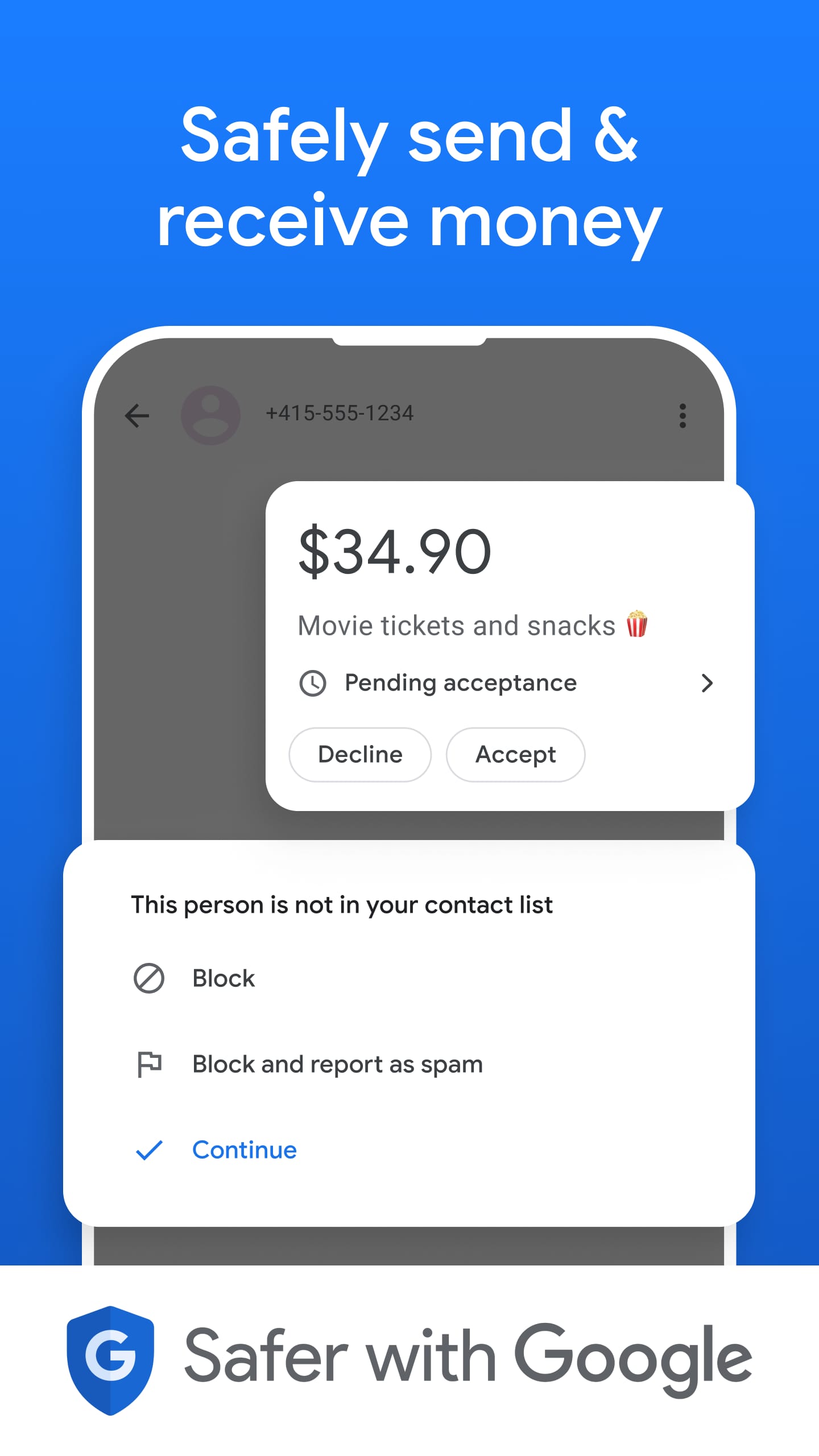

- In - App Purchases & Money Transfers: Allows secure in - app purchases and easy money transfers.

- Budget Tracking & Insights: Some versions offer basic budget - tracking to understand spending habits.

- Enhanced Security & Fraud Protection: Uses multi - layered security like tokenization and verification.

- Financial Goal Setting: Some versions let you set and track financial goals.

How Google Pay Works

- First, integrate it with your Android phone and add your debit or credit cards from participating banks.

- For in - store payments, unlock your phone and hold it near the contactless payment terminal.

- For in - app purchases, select Google Pay as the payment method on supported platforms.

- To transfer money, use the built - in money transfer feature in the app.

Pros and Cons of Google Pay

Pros:

- Wide merchant network acceptance for easy everyday use.

- Seamless integration with the Google ecosystem.

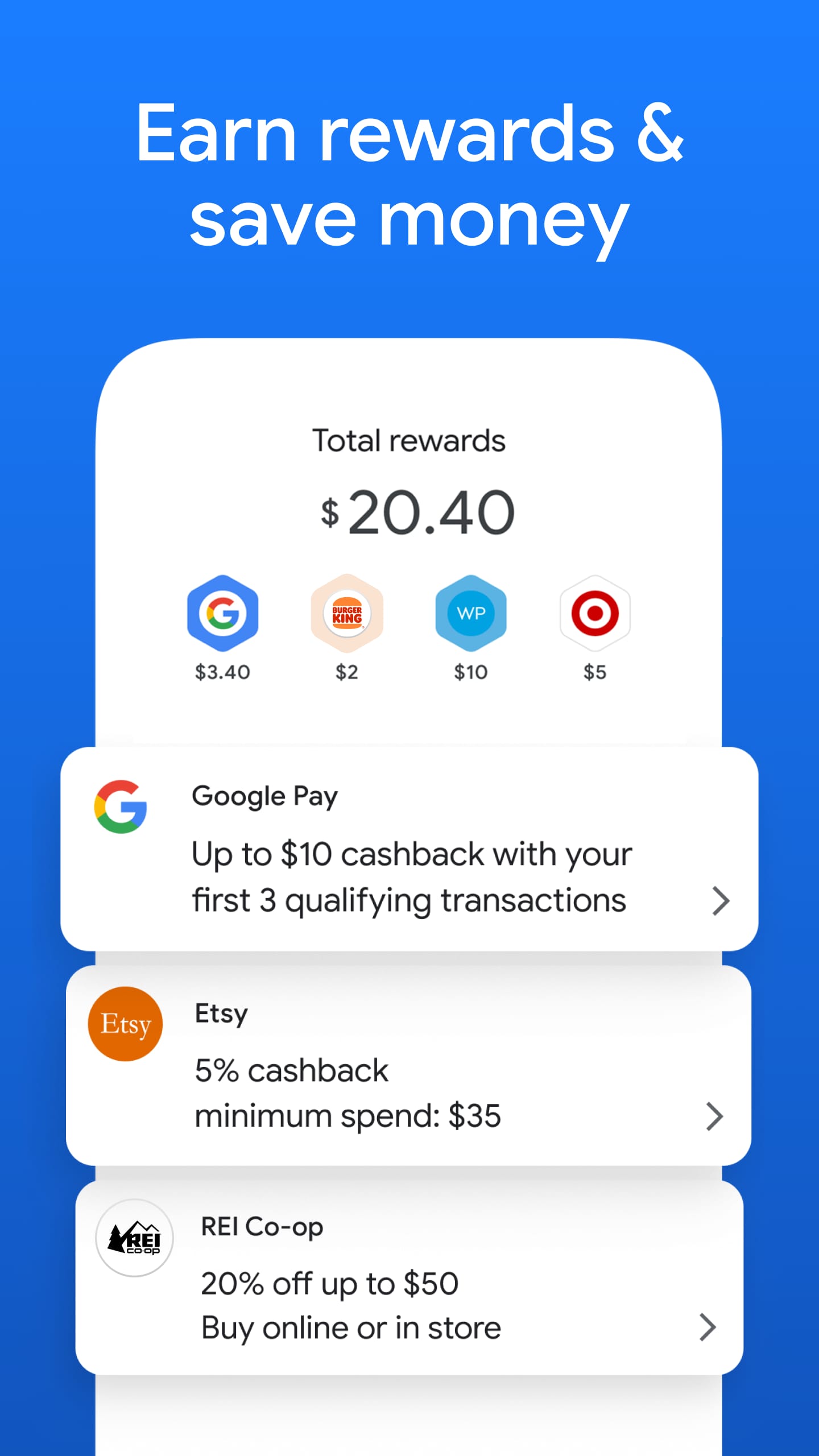

- Potential to earn rewards and cashback.

- High - level security features to protect financial information.

Cons:

- Requires an Android phone for full functionality.

- Budget - tracking features may not be as comprehensive as dedicated budgeting apps.

Conclusion

Google Pay is a powerful and convenient app that simplifies financial management. With its wide range of features, high - security measures, and integration with Google services, it's a great choice for Android users. Despite some minor limitations, it offers a seamless payment experience and helps users stay on top of their finances.