What is Venmo

Venmo is a famous mobile payment service owned by PayPal. It's mainly for peer - to - peer transactions, letting users send and receive money among friends. It combines finance with social media, allowing users to add notes and emojis to transactions and share them on a public feed.

Features

- Social Payments: Merges financial transactions with social media, with customizable privacy settings.

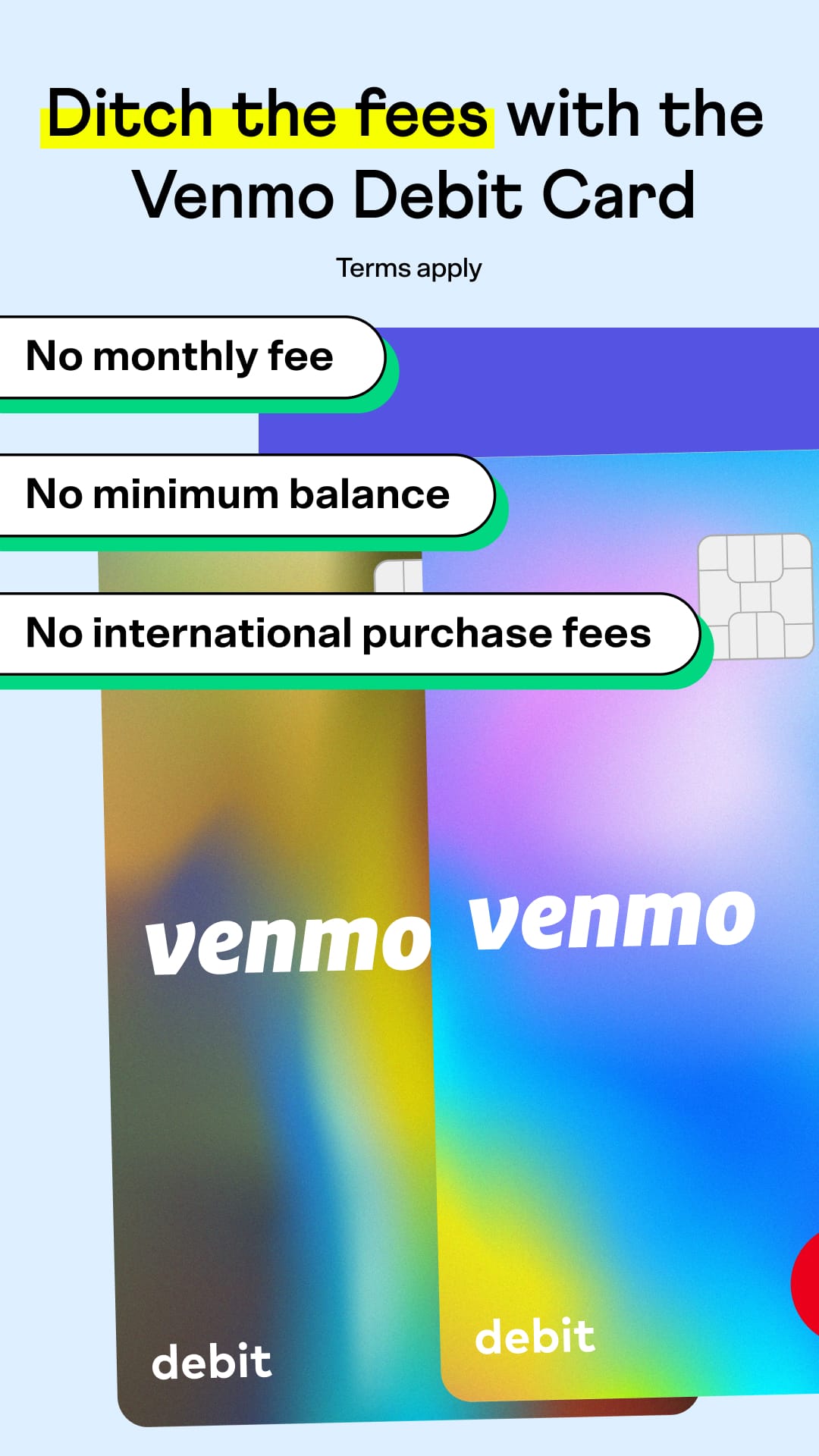

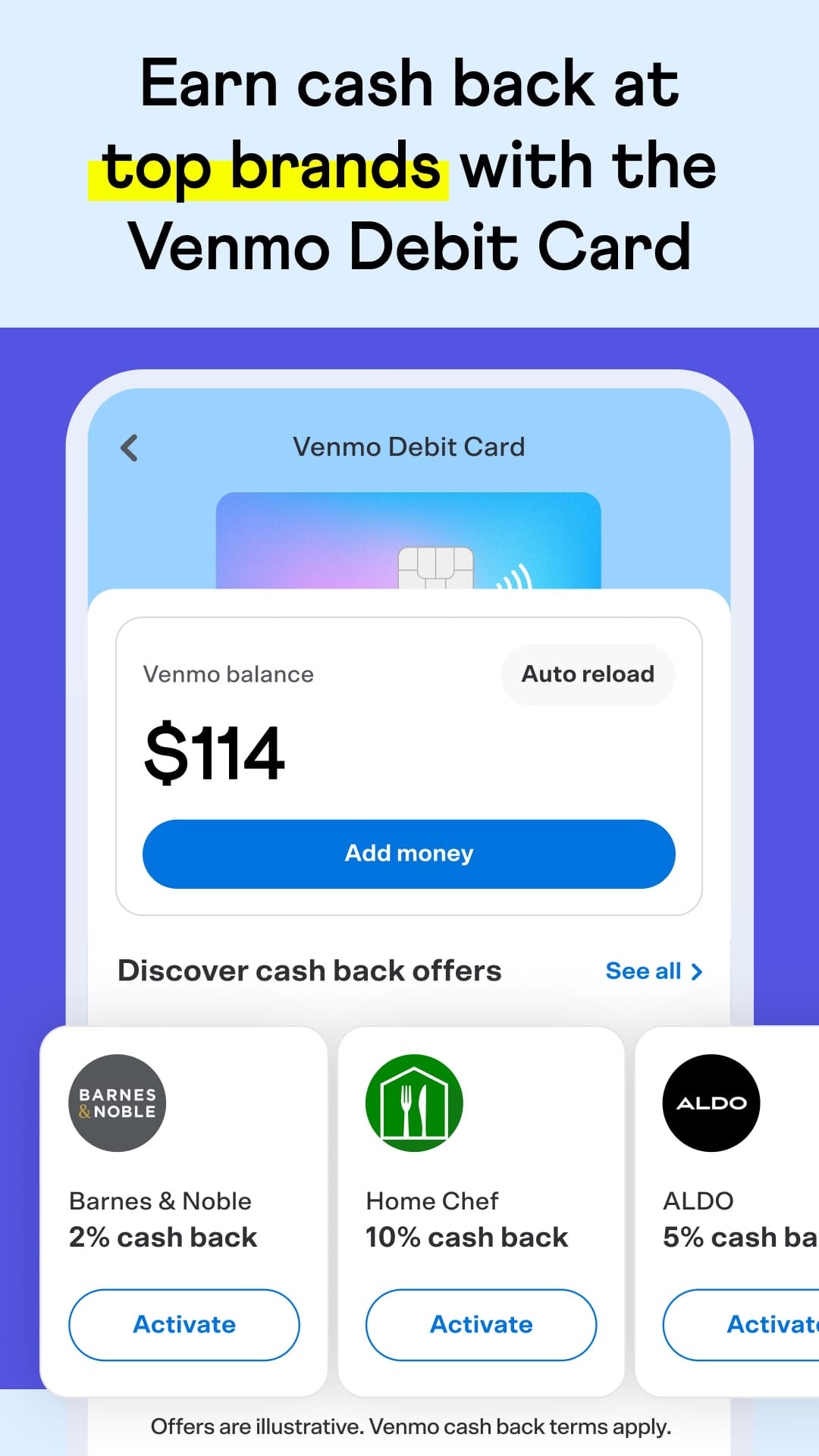

- Versatile Funding Options: Supports bank accounts, debit/credit cards, Venmo balance, direct deposits, and cryptocurrency transactions.

- Pay at Retailers: Allows direct payment for goods and services at participating stores.

How Venmo Works

- Create an account using an email or Facebook.

- Connect a bank account, debit card, or credit card.

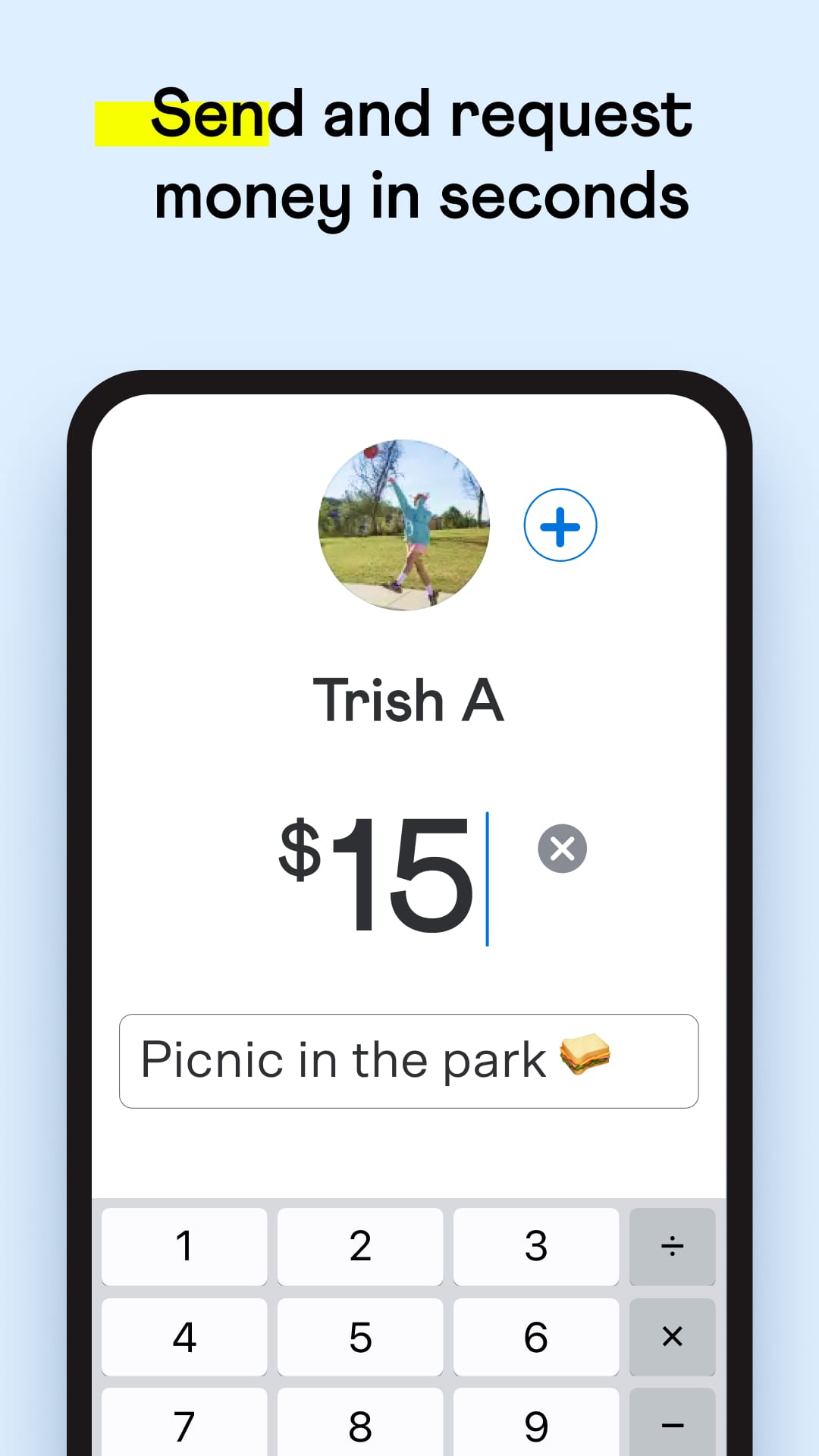

- Send payments or request money from other users, add notes, and manage privacy.

Pros and Cons of Venmo

Pros: User - friendly, strong security, backed by PayPal, social payments feature, versatile funding options, can pay at retailers.

Cons: Available only in the US, has transfer limits, no international transfers, 3% fee for credit card use.

Conclusion

Venmo provides a distinctive mix of financial services and social engagement. With its user - friendly interface and various features, it's great for US users who split bills. Despite some limitations, it's a reliable and fun P2P payment app.